Recent Blog

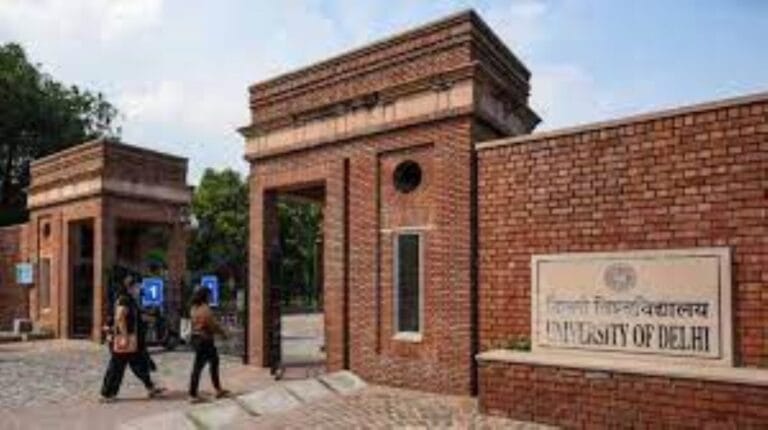

DU Admission Policy Announced Delhi University (DU) Vice-Chancellor Yogesh Singh released the university’s admission policy...

The exam on November 20 was successfully conducted in 177 cities and 338 centers in...

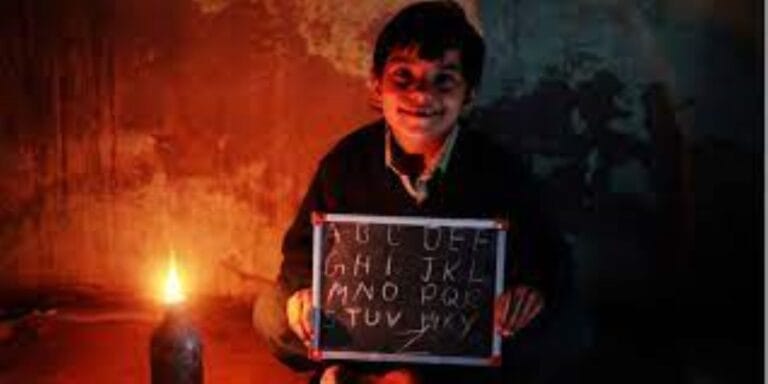

The study also found that each rupee invested in completing school studies is expected to...

The report points out that the increase in public school enrollment is almost uniform across...

According to the survey, about 59% of girls between the ages of 15 and 24...

Although data from the Open Doors Report 2021 shows a sharp drop in student numbers...

CLAT 2023 will take place five months before December 2022 instead of May 2023. The...

The survey, which will cover public, private and government-funded schools, will help assess disruption in...

Judicial Services Examination or PCS (J) -Provincial Civil Service-Judicial Examination is for law graduates to...

Students will be able to enter the three-year interdisciplinary course from next year and classes...

The central government is preparing to give new impetus to the establishment of an All...

UPSC National Defense Academy (NDA) and Naval Academy (NA) II exams will take place on...

The NTA will organize the UGC NET 2021 exam from November 20 to December 5...

The Supreme Court agreed to consider whether education is a service under the Consumer Protection...

IIT Bombay obtained an overall score of 71 out of 100. Last year, the institute...