Finance Minister Nirmala Sitharaman announced on Monday two rounds of measures aimed at generating consumer demand and boosting capital spending in the economy. The measures announced by the government, together with the participation of states and the private sector, according to the government, are expected to create an “additional demand” of Rs 1 lakh crore in the economy.

- Sitharaman said that supply constraints in the economy have been relaxed, but consumer demand is still affected. Some proposals are aimed at increasing spending, while others are “directly linked to increasing GDP (gross domestic product)”.

- The ministry has decided to allow government and private sector employees to use their tax-free travel allowance for various types of purchases subject to certain conditions, while an interest-free festival advance of Rs 10,000 is granted to government employees. The Center and the States announced measures to increase capital spending.

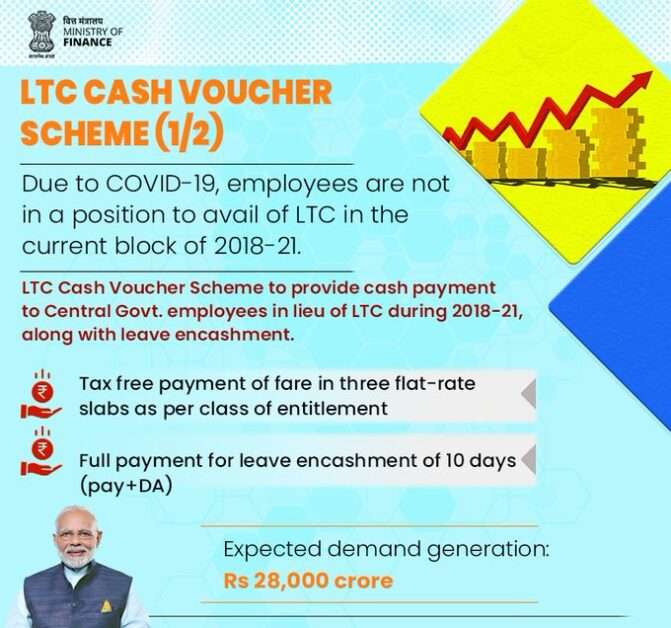

How do long-term care benefits affect you?

- The government announced Monday that central government employees will enjoy tax benefits on the LTC component without having to travel. However, these employees would have to spend three times the LTC fee component to purchase items that attract 12 percent or more of GST.

- What this effectively means is that if your LTC fee component is Rs 40,000, you have to spend Rs 1.2 lakh on goods that fall 12% or more from the GST slab to save taxes by Rs 40,000.

- On the other hand, if you don’t spend that amount, you may have to pay taxes based on your marginal tax rate on the LTC component. So if you fall into the 10% tax mosaic, you will have to pay an additional tax of 4,000 rupees and if you fall into the 30% tax mosaic, you will have to pay an additional tax of around 12,000 rupees on the tax amount Rs 40,000 LTC fees.

- As for the license fee component of LTC, the employee will have to spend an equivalent amount for the purchase of goods attracting 12% GST or more.

What benefit will this bring to the economy?

- Thanks to the LTC consumption stimulus package, the government expects a demand generation of Rs 28 billion in the economy. While it expects an additional demand generation of around Rs 19 billion due to demand from central government employees, it expects an additional demand generation of an additional Rs 9 billion from Government Employees.

- Additionally, the government has stated that the same benefits would be offered to private sector employees if employers choose to offer the plan to their employees and decide to take advantage of it.

How does this benefit government revenue?

- While GST collection was severely affected in the first half of the fiscal year due to the Covid-19 pandemic, an increase in the consumption of the LTC component of the salaries of central government employees and the State will increase collection of the GST from the second half of the year under the schedule of planned expenditures until March 31, 2021. If employees from the private sector also participate, this can lead to a significant jump in consumption. overall and an increase in GST collection.

What is the festival’s advanced special program?

- The government has reinstated the festival advance, which was abolished in accordance with the recommendations of the Payments Commission 7, for once until March 31, 2021. As a result, all central government employees will benefit from an advance without Rs 10,000 interest to be recovered by the government in 10 installments.

- It will be delivered in the form of a Rupay card preloaded with the value of the advance and the government plans to disburse Rs 4 billion under this plan. According to the Finance Ministry, if all states offer a similar advance, another Rs 8 billion should be disbursed. This should generate consumer demand ahead of festivals like Diwali.

What are the measures to boost capex and their impact?

- Special assistance will be provided to states in the form of 50-year interest-free loans of Rs 12 billion under certain conditions. The states have been categorized into three groups: Group 1 which includes the Northeastern States (Rs 1600 crore) and Uttarakhand and Himachal Pradesh (Rs 900 crore), Group 2 has other states which will receive Rs 7,500 crore in proportion to their share according to Finance Reimbursement Commission, and Group 3 has states that will get a total of Rs 2 billion if they comply with three of the four reforms, including One Nation One Ration, outlined in the government’s Atma Nirbhar package announced in early May.

- The funds, which must be spent by March 31, 2021, can be used by states for new and ongoing projects and to pay contractors’ bills on those projects.

- Funds provided to states will exceed their maximum borrowing limits.

- For its part, the Center has proposed an additional budget of Rs 25,000 crore for capital expenditure on roads, defense infrastructure, water supply, urban development, allocations to be made to different ministries during discussions to come to make revised estimates. Sitharaman said capital spending has “a high multiplier effect” on the economy and is expected to stimulate demand in various sectors of the economy.

More Stories

Registration for CLAT 2025 begins today; last date October 15

CLAT 2025 registration will begin on July 15

Delhi University 5 Year Law Programs Registration Begins