BLOGS

Fiscal Deficit for 2021

The fiscal deficit for the year 2021 can reach 8% of GDP

Table of Contents

ToggleThe Centre’s fiscal deficit in the first three months of fiscal year 2020-21 was Rs. 6.62 lakh crore, or 83% of the budgeted target for the year, according to official data.

- Economists said that the government’s additional borrowing plans, both to cover stimulus spending and to reduce the income deficit in the wake of the pandemic, the budget deficit could reach 8% of GDP, far exceeding the budget target of 3.5%.

- Union government received the Center’s total spending for the quarter at 8.15 crore, nearly 27% of the budget forecast for the year, according to the report released by the authority on Friday.

- The Center also transferred Rs. 1.34 lakh crore to the States as their share of taxes, which is Rs. Rs. 14,588 million less than the previous year.

- Rs 1.53 million (in terms of taxes, non-tax revenue and loan collections) from April to June.

- This is less than 7% of the budget forecast for the entire year.

- According to the report released by the govt. authority on Friday, the centre’s total spending for the quarter was 8.15 crore, almost 27% of the budget forecast for the year.

- The Center also transferred Rs. lakh 1.34 crore to states as part of its tax share, Rs. 14,588 crore less than the previous year.

- Rs 8.15 million, or nearly 27% of the budget forecast for the year, according to the report released Friday by the auditor general.

- The Center also transferred to the states 1.34 million rupees as part of its tax share, down 14.588 billion rupees from the previous year.

- 40% growth in the first quarter of capital expenditure to Rs. 88.273 million rupees. Looking at the data for the last 20 years, this is historically high, in terms of annual percentage growth for the first quarter.

Your Comprehensive Guide to the Common University Entrance Exam LLB (CUET LLB)

Delhi University to Launch One-Year Postgraduate Programme in 2026

CLAT 2025 Counselling Registration Window Closes Today

The Surge in Indian Students Studying Abroad | A Five-Year Analysis

IIM CAT Result 2024 | 14 Candidates Score Perfect 100 Percentile

AIBE 19 Exam 2024 | Complete Guide

NLSIU Bengaluru to Launch 3-Year BA (Hons) Programme in 2025 | Key Details

CUET-UG to Be Fully Online: Key Changes Announced by UGC

D.Pharma Course in India | Careers After Class 12th

The Draft UGC (Minimum Standards of Instructions in the Award of UG and PG Degrees) Regulations 2024 | A Comprehensive Overview

FinCEN files

What are FinCEN files?

Table of Contents

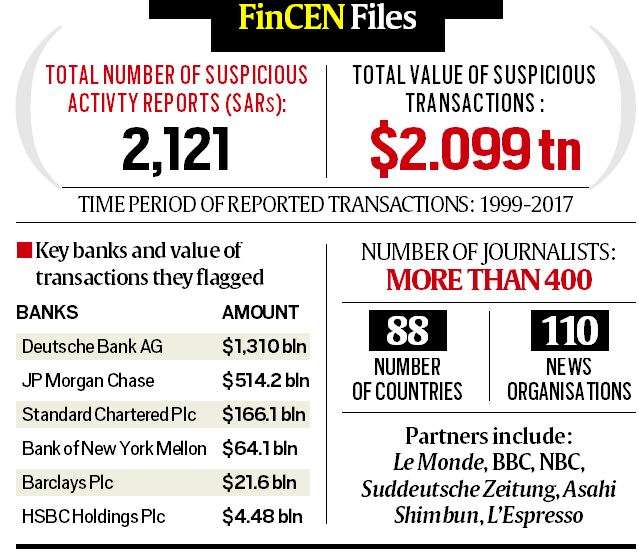

ToggleThe FinCEN files refer to a collection of over 2,100 “suspicious activity reports” (SAR) filed by banks with the Financial Crimes Enforcement Network of the United States Department of the Treasury, the agency which acts as the main global regulator in the fight against money laundering.

- The files identify at least $ 2 trillion in transactions between 1999 and 2017, marked as possible evidence of money laundering or other criminal activity by compliance officials of banks and financial institutions.

So what is a SAR? When should they appear?

The SAR or Suspicious Activity Report is a document submitted by banks and financial institutions to report suspicious activity to US authorities, in this case FinCEN. These are confidential, so secret that the banks cannot confirm their existence. In fact, even the account holder does not know when a transaction related SAR is deposited into that account.

- SARs are filed with FinCEN in a prescribed format and are intended to be a red flag, within 30 days of the transaction; criminal funds or any form of dirty money; insider trading; potential money laundering; financing of terrorism; any transaction that raises suspicion.

- These include rounded amounts, for example $ 100,000, which are sent in multiple transactions; transfers where there is no apparent economic link between the parties (a diamond dealer paying a pizzeria for computer parts); transactions in high risk jurisdictions (offshore havens, conflict zones); transactions to / by PEPs (politically exposed persons) and, finally, unfavorable media reports on the parties.

Who can file a SAR?

- Banks, sure, but now that list has been expanded to include brokerage houses, brokers, and casinos. Failure to submit the SAR can result in heavy penalties. In recent years, Deustche Bank, HSBC and Standard Chartered Bank, among others, have received huge fines for inadequate supervision. Credit card systems are not required to submit RAS and all taxpayers must keep RAS records for five years.

But is the SAR a test of criminality, of illegality? If not, what is its importance?

- A SAR is not a charge, it is a means of alerting regulators and law enforcement to possible irregular activities and crimes. SARs are shared by FinCEN with law enforcement authorities including the FBI, Immigration, and US Customs, they are used to detect crimes, but not as direct evidence to prove legal matters. In the world of international finance, where money circulates under several levels to evade or avoid taxes, SARs are the first red flags.

Is there an equivalent of SAR in India?

- Yes. The Financial Intelligence Unit of India (FIU-IND) performs the same functions as FinCEN in the U.S. Under the Ministry of Finance, it was established in 2004 as the nodal agency responsible for suspicious financial transactions.

- The agency is authorized to obtain monthly cash transaction reports (CTR) and suspicious transaction reports (STR) and reports of cross-border wire transfers from public and private sector banks under the Prevention Act PMLA Money Laundering).

- Banks in India are required to provide a monthly CTR to FIU on all transactions over Rs 10 lakh or its equivalent in foreign currency or a series of fully connected transactions totaling more than Rs 10 lakh or its equivalent in foreign currency.

- ROS and CTR are analyzed by the FIU and suspicious or questionable transactions are shared with agencies such as the Compliance Department, the Central Bureau of Investigations and Income Tax in order to launch surveys to verify possible money laundering cases, money, tax evasion and terrorist financing.

- The CRF’s 2017-2018 annual report reveals that it received a record 14 lakh of RTS after demonetization, three times the number of RTS submitted the previous year.

How is FinCEN Files based on the Panama Papers, Paradise Papers and the Offshore Leak Series?

- Countries keep their banking transaction alerts within their borders. FinCEN files indicate that after the series of disclosures and leaks of overseas holdings in tax havens, the veil of confidentiality can be lifted even on wire and bank transfers.

- One benchmark was the publication of the Panama Papers in 2016 and, as calculated by the ICIJ last year, the total tax collected as a result of the global media investigation was $ 1.2 billion.

- In India, the figures provided by the Central Board of Direct Taxes (CBDT) do not refer to taxes collected, but to undeclared taxes collected which as of mid-2019 amounted to Rs 1,564 crore.

What clues could the FinCEN archives give researchers in India?

- The clear message for agencies in India is that their cases of financial fraud and corruption are being reported by the most powerful regulator in the world.

- This is because FinCEN files contain SARs that in many cases of Indian entities and individuals mention their financial history of alleged wrongdoing.

- There are bank transaction details that give a clear indication of round trips, money laundering, or transactions with shell-like entities. For the Indian banking sector, FinCEN’s files highlight the dangers posed by correspondent banks and raise a very relevant question: the thousands of transactions involving Indian entities and individuals reported by FinCEN have also been reported by banks to the CRF here, especially since 44 Indian banks were cited in the secret data, and if so, what was the result?

How did these files get to ICIJ?

- These documents were compiled by Congressional committees investigating Russian interference in the 2016 US presidential election. BuzzFeed News obtained these tapes and shared them with the International Consortium of Investigative Journalists. ICIJ has partnered with a team of news organizations to investigate the secret world of banking and money laundering.

- BuzzFeed News referenced these SARs in 2018 to reveal secret payments to shell companies controlled by Paul Manafort, who is currently serving a federal prison sentence at his home in a case based primarily on these transactions. Former US Treasury Department official Natalie Mayflower Sours Edwards has been charged with conspiracy to unlawfully disclose documents to Buzzfeed. Buzzfeed has not commented on its source.

Your Comprehensive Guide to the Common University Entrance Exam LLB (CUET LLB)

Delhi University to Launch One-Year Postgraduate Programme in 2026

CLAT 2025 Counselling Registration Window Closes Today

The Surge in Indian Students Studying Abroad | A Five-Year Analysis

IIM CAT Result 2024 | 14 Candidates Score Perfect 100 Percentile

AIBE 19 Exam 2024 | Complete Guide

NLSIU Bengaluru to Launch 3-Year BA (Hons) Programme in 2025 | Key Details

CUET-UG to Be Fully Online: Key Changes Announced by UGC

D.Pharma Course in India | Careers After Class 12th

The Draft UGC (Minimum Standards of Instructions in the Award of UG and PG Degrees) Regulations 2024 | A Comprehensive Overview

Final Press Conference on Economic Package

With a combination of various reforms, fiscal and liquidity measures, Finance Minister Nirmala Sitharaman today completed the announcement of the final stage of Rs. The 20 lakh crore economic package previously announced by Prime Minister Narendra Modi. To improve the livelihoods of the poor, the Modi government has today increased the MGNREGA budget increased by additional Rs. Rs 40 billion. Sitharaman also announced that public sector companies or PSUs will leave non-strategic areas and that private companies will be able to enter all sectors.The Minister of Finance also detailed the distribution of rupees. Package of 20 lakh crore including liquidity measures of Rs. 8 lakh crore announced earlier the RBI, as well as Prime Minister Gareeb Kalyan Yojana.

Table of Contents

ToggleHighlights

- Centre has decided to accede to the request and increased borrowing limits of states from 3% to 5% for 2020-21.

- States have so far borrowed only 14% of the limit authorised but 86% of the authorised borrowing remains unutilised.

- Revenue deficit grants to states worth Rs. 12,390 crore given on time in April and May, despite Centre’s stressed resources.

- Devolution of taxes worth Rs. 46,038 crore in April was given fully as if Budget estimates were valid, even though actual revenue shows unprecedented decline from Budget estimates.

- New policy to broadly categorise strategic sectors Public sector enterprise policy.

- All sectors will be open to private sectors also while PSUs will play an important role in defined areas.

- Lower penalties for all defaults for small companies, one-person companies, producer companies and start-ups.

- Companies listing only NCDs on stock exchange will not be regarded as listed companies.

- Direct listing of securities in foreign jurisdictions permitted.

- The amendments in Companies Act will de-clog criminal courts and NCLT.

- Decriminalisation of Companies Act violations involving minor technical and procedural defaults, majority of compoundable offences sections to be shifted to internal adjudication mechanism.

- Minimum threshold to initiate insolvency proceedings raised to Rs. 1 crore from Rs. 1 lakh. This will largely insulate MSMEs.

- No fresh insolvency proceedings upto 1 year, Debts related to Covid shall be excluded from IBC.

- Top 100 universities will be permitted to automatically start online courses by May 30 this year.

- Extensive use of radio, community radio and podcasts One TV channel will be earmarked for every class from 1 to 12.

- Online education during Covid; Provision for live telecast of interactive channels with experts through Skype.

- Health and wellness centres in urban and rural areas will be increased, Public health expenditure will be increased, The central govt has already announced Rs. 15,000 crore healthcare funds to fight Covid-19.

- Govt to allocate additional Rs. 40,000 crore for MGNREGA to provide employment boost. It will help generate 300 crore person days in total.

- 12 lakh EPFO subscribers withdrew Rs. 6,060 crore under the Covid pandemic withdrawal.

- Jan Dhan account: 20 crore women got more than Rs. 10,000 crores.

- PM Gareeb Kalyan Package Yojana: Direct benefit transfer has reached 8.9 crore farmers. Amount disbursed Rs. 16,394 crores.

- The definition of “covid-related debt” will be announced soon in a notification,

- RBI measures of Rs. 801,603 included in Rs. 20 lakh crore economic package.

- Total stimulus package is worth Rs. 20,97,053 crore, Fourth and fifth tranche is worth Rs. 48,100 crore,

- Stimulus measures announced in third part worth Rs. 1.5 lakh crore Second tranche was worth Rs. 310,000 crore,

- Economic package tranche 1 was worth Rs. 594,500 crore Stimulus measures from earlier announcements was worth Rs. 192,800 crore,

- Revenue loss due to tax concession is Rs. 7,800 crore This will give states extra resources of Rs. 4.28 lakh crore.

Your Comprehensive Guide to the Common University Entrance Exam LLB (CUET LLB)

Delhi University to Launch One-Year Postgraduate Programme in 2026

CLAT 2025 Counselling Registration Window Closes Today

The Surge in Indian Students Studying Abroad | A Five-Year Analysis

IIM CAT Result 2024 | 14 Candidates Score Perfect 100 Percentile

AIBE 19 Exam 2024 | Complete Guide

NLSIU Bengaluru to Launch 3-Year BA (Hons) Programme in 2025 | Key Details

CUET-UG to Be Fully Online: Key Changes Announced by UGC

D.Pharma Course in India | Careers After Class 12th

The Draft UGC (Minimum Standards of Instructions in the Award of UG and PG Degrees) Regulations 2024 | A Comprehensive Overview

AatmNirbhar Bharat AIBE AIBE17 CACP CBSE CLAT CLAT 2025 CORONA VACCINE Coronavirus COVID 19 COVID19 CUET PG CUET UG CUET UG 2023 DU Admission Facebook Fiscal deficit fiscal stimulus FOREIGN EXCHANGE RESERVES GDP GI Tag GI TAGS In iNDIA GST GST COMPENSATION indian economy INDO-CHINA BORDER DISPUTE INDO-CHINA CONFLICT INFLATION INSTAGRAM JIO lockdown MONETARY POLICY COMMITTEE MPC MSP NIRF nobel prize 2020 PMI RAFALE FIGHTER JET RBI RBI GOVERNOR RELIANCE INDUSTRIES LIMITED REPO Rate RIL twitter UNIVERSITY OF DELHI

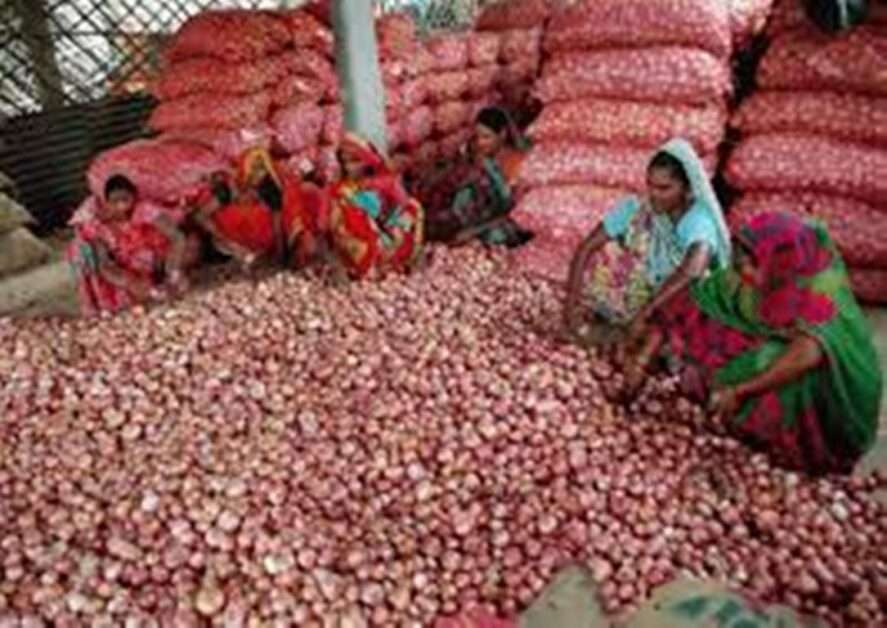

Farmers’ protest in Haryana

On Thursday, farmers’ organizations in Haryana defied ban orders imposed amid the pandemic to stage a protest at the Pipli grain wholesale market, near Kurukshetra. They even blocked the Delhi-Chandigarh national road for a few hours, when the police initially did not allow them to go there.

Table of Contents

Toggle- Its objective was three basic laws promulgated by ordinances of June 5; the Ordinance on Trade and Trade in Agricultural Products (Promotion and Facilitation), the Ordinance on Essential Products (Amendment) and the Agreement of Farmers (Empowerment and protection) on insurance Prices and agricultural services. Ordinance, 2020.

- These protests, preceded by sit-ins across Punjab, are expected to gain momentum after September 14, when parliament meets for the monsoon session.

How widespread is the unrest in Haryana?

For now, these appear to be largely limited to the Punjab and Haryana. Maharashtra peasant leaders, including Raju Shetti of Swabhimani Paksha and Anil Ghanwat of Shetkari Sanghatana, welcomed the ordinances. Shetti, two-time MP for Lok Sabha, called them “the first step towards financial freedom for farmers.”

- The opposition of the Punjab and Haryana farmer groups also relates mainly to the first ordinance allowing the sale and purchase of crops outside the mandis regulated by the state government APMC (Commodity Market Committee agricultural).

- They probably don’t have any real problems with the other two ordinances, which fundamentally eliminate the imposition of limits on food storage (except in “extraordinary circumstances” such as war and serious natural disasters) and make cultivation easier set back (where farmers can make deals with buyers before any growing season).

What is the first order about?

In a letter to Sukhbir Singh Badal, chairman of Shiromani Akali Dal (which is part of the ruling alliance in the Center), Union Agriculture Minister Narendra Singh Tomar said the ordinance simply provides for “Commercial areas” outside the physical boundaries of APMC mandis.

- These would serve as an “additional marketing channel” for farmers, even if CMPAs “will continue to operate”. The freedom of choice to sell outside of regulated mandis should help farmers obtain better prices for their products.

- In addition, “it will motivate CMPAs to dramatically improve the efficiency of their operations to better serve farmers.” APMCs may charge mandi fees and other fees as before, but these will only be for trades that take place within the physical limits of their primary trading prices or sub-prices.

So what is fueling the protests?

There are two pilots. The first concerns farmers, who see the dismantling of the APMC monopoly as a precursor to the end of the existing system of grain purchasing by the government at guaranteed minimum support prices (MSP).

- In 2019-2020 alone, the government agencies of Punjab and Haryana purchased 226.56 lakh tonnes (lt) of rice and 201.14 lt of wheat, the value of which, in their respective MSPs of Rs 1,835 and Rs 1,925 per quintal, would have been Rs 80,293.21 crore.

- The ordinance itself does not mention anything, directly or indirectly, which suggests the end or the gradual withdrawal of public procurement based on the PSM. But peasant leaders say the real intention of the latest reforms is to implement the recommendations of the High Level Committee on Restructuring the Food Corporation of India (FCI) led by Shanta Kumar. This panel, which presented its report in 2015, asked the FCI to hand over all procurement operations in Punjab, Haryana, MP, Chhattisgarh, Odisha and Andhra Pradesh to government agencies. .

- “The committee wanted the Center to withdraw from acquisitions and leave everything to the States. Where do they have the money to buy and store so much grain? This… is only intended to be an exit strategy from the Center, ”said Jagmohan Singh, general secretary of the Union Bhartiya Kisan (Dakaunda faction).

- The Punjabic congressional government also passed a resolution in the assembly on August 28 urging the Center to make purchases based on the MSP “a legal right of farmers.” In addition, he asked for a “continuation” of this recruitment via the FCI.

What is the second driving force behind the protests?

This comes from the state governments and the arhatiyas (commissioners) in Mandis. The Arhatiyas (Punjab alone has about 28,000) provide platforms outside their stores, where farmers’ products are unloaded, cleaned, auctioned, weighed and bagged before loading. and out.

- They receive a 2.5% commission in addition to the MSP. These payments amounted to more than Rs 2 billion in Punjab and Haryana last year. States also derive substantial revenue from various liens on the value of products traded at APMC. Punjab’s annual income from mandi fees and “rural development”, totaling 6% for rice and wheat, 4% for basmati and 2% for cotton and maize, is estimated at 3,500 rupees. 3,600 crore. All of this would obviously be affected if operations were to move away from the mandis.

- As noted above, the response to the orders has been inconsistent. Shetti and Ghanwat believe that farmers will benefit if processors, retailers or exporters invest in infrastructure for direct supply.

- Farmers currently spend money transporting their produce to the mandis, which they can save if purchases are made closer to their fields. But even these leaders believe the Center should reach out to farmers in Punjab and Haryana to clear up any misunderstandings.

- The hasty way in which prescriptions were broken, at the height of the pandemic, may also have contributed to the trust deficit.

Your Comprehensive Guide to the Common University Entrance Exam LLB (CUET LLB)

Delhi University to Launch One-Year Postgraduate Programme in 2026

CLAT 2025 Counselling Registration Window Closes Today

The Surge in Indian Students Studying Abroad | A Five-Year Analysis

IIM CAT Result 2024 | 14 Candidates Score Perfect 100 Percentile

AIBE 19 Exam 2024 | Complete Guide

NLSIU Bengaluru to Launch 3-Year BA (Hons) Programme in 2025 | Key Details

CUET-UG to Be Fully Online: Key Changes Announced by UGC

D.Pharma Course in India | Careers After Class 12th

The Draft UGC (Minimum Standards of Instructions in the Award of UG and PG Degrees) Regulations 2024 | A Comprehensive Overview

Facebook controversy

A recent article in the Wall Street Journal spoke of a political problem in Facebook’s operations in India that hit the house hard. They said senior Facebook executives in India lifted the company’s checks and balances to allow posts from a far-right politician who openly called for violence against Muslims.

Table of Contents

Toggle- The WSJ article also blamed Facebook’s India policy chief Ankhi Das for the decision, who the article said said removing the posts would not be in line with Facebook’s business interests in India.

- There is a straight line between this very political decision and what the average Indian smartphone user sees and reads, who spends 4.3 hours online per day.

- It also fuels the global debate about the influence of tech giants like Facebook and Google on their users’ politics, using personal data to target content and ads that sometimes serve as feedback loops for prejudice and bias. false opinions.

- India, as the largest market for the company’s eponymous social media platform and its WhatsApp messaging utility, has a lot of exposure to the data-absorbing machines that operate behind the user-friendly facades of its apps.

- However, the novelty of the social network for a population that received its first smartphones far outweighed the privacy concerns. This compromise between convenience and privacy is the staircase, or rather the high-speed elevator, on which companies like Facebook, Google and Amazon have placed their business model.

The Beginning of Facebook

Facebook, like most social media platforms today, is a child of section 230 of the United States’ Communications Decency Act of 1996. Section 230 is a safe haven provision. which protects online platforms from legal liability for what their users download or post.

- Its parallel in India is section 79 of the Information Technology Act 2000. Section 230 allowed Mark Zuckerberg to launch Facebook from his dorm at Harvard in 2003 without having to think about the legal ramifications of what users coveted him, would publish on the site.

- Combine that with some very smart thinking about how people connect with each other, along with an ecosystem that maximizes engagement in the form of innocent-looking like buttons, and you get the explosive mix that Facebook was putting in place at the end of the decade 2000 and early 2010.

- What began as a social network for students at America’s most elite universities quickly spread to more universities and businesses before opening up to everyone in 2006.

- The 2006 also saw the launch of Newsfeed, powered by an algorithm that pushed it to images and people with which the user is likely to interact more.

- While the initial damage was limited to bruised egos and mild to strong envy, it would soon escalate into intimidation and depression, culminating in the maelstrom of misinformation and biased information that would upset a presidential election.

- More on that later for now, Facebook was harnessing the growing pride around tech and Silicon Valley as young people leading democratic protests like the Arab Spring of 2011 used social media platforms to great effect, baffling unsuccessful dictatorships. had not yet discovered their effectiveness. of the meme as a political weapon.

The money is coming

However, as politics increased and images of cats and cakes from friends and family were lost in opinions and articles on “You would not guess what happened next,” young people began to move.

- Facebook did not have a Revolutionary new millennium product to stem the tide – but what it lacked in innovation it made up for.

- Acquired Instagram in 2012 for $ 1 billion, extending its reign as the king of social media to this day and into the foreseeable future Then in 2014, it acquired WhatsApp for $ 19 billion, even though its own Messenger service had a strong position in the growing private messaging space.

- Facebook also recently invested $ 5.7 billion to buy a 10% stake in Jio from Reliance, which fits the dominant buying model. Facebook’s money maker is its advertising service.

- A wealth of likes and dislikes is at your fingertips. What people have expressed publicly on their platforms, as well as an equally vast amount of information, such as location, that users consider private.

- With this, Facebook has the means to allow advertisers to target people with a precision that Google cannot match. So it’s no wonder that Google and Facebook together control about three-quarters of the global digital advertising market, worth more than $ 350 billion in 2020.

The problems

It was on this mountain of data and precision targeting capabilities that he built his empire that Facebook’s downward slope also began. In the early years, third-party developers creating apps like games and quizzes for Facebook were allowed to extract data on who was using the app and, blatantly, their friends.

- A large mine of this data has been entrusted to Cambridge Analytica, a consulting firm.

- In 2018, a whistleblower from the company revealed that the data had been used to create the personality profiles of millions of Americans and that those identified as susceptible were being targeted with pro-Trump material and conspiracy theories to change voting behavior.

- The accusation that Facebook’s flawed data policies could have caused one of the biggest election riots in U.S. history in 2016 immediately put the company on its feet, and has been ever since.

- It was quickly hit by more and more accusations of mismanaging data and allowing deadly misinformation to spread unopposed across its platforms.

- He realized that, unlike the ignorant digital dictators of 2011, there were many codebreakers who cracked the code by selling themselves online as nationalists and benefactors using the same advertising mechanism that sells shoes and vacations.

- The mass killings of Rohingya Muslims in Myanmar, sparked by community Facebook posts, and the lynching of Muslims in India based on WhatsApp messages confirmed the account.

- However, the biggest penalty Facebook has incurred for mishandling user data is the “paltry” amount of $ 5 billion from the US Federal Trade Commission. In fact, after the fine was announced, Facebook’s market value increased by more than $ 10 billion.

The responsibility ends with Zuck

In the middle of it all is Mr. Zuckerberg, When Facebook went public in 2012, it held a majority stake. That means it’s your writing that is the law on Facebook. And your mistakes are Facebook mistakes.

- It is logged in emails that minimize the potential impact of Facebook’s data privacy practices on users. Chris Hughes, Facebook co-founder and friend from Zuckerberg’s Harvard dorm, wrote in the New York Times that Zuckerberg initially frequently used the term “domination” to describe his ambitions, which seem to be the position Facebook took.

- However, during his 17 years at the helm, he also led the company from the defining history of this century’s tech entrepreneurship to an uplifting tale of unbridled Silicon Valley hedonism.

Your Comprehensive Guide to the Common University Entrance Exam LLB (CUET LLB)

Delhi University to Launch One-Year Postgraduate Programme in 2026

CLAT 2025 Counselling Registration Window Closes Today

The Surge in Indian Students Studying Abroad | A Five-Year Analysis

IIM CAT Result 2024 | 14 Candidates Score Perfect 100 Percentile

AIBE 19 Exam 2024 | Complete Guide

NLSIU Bengaluru to Launch 3-Year BA (Hons) Programme in 2025 | Key Details

CUET-UG to Be Fully Online: Key Changes Announced by UGC

D.Pharma Course in India | Careers After Class 12th

The Draft UGC (Minimum Standards of Instructions in the Award of UG and PG Degrees) Regulations 2024 | A Comprehensive Overview

Exit of Shapoorji Pallonji from Tata

The Shapoorji Pallonji group told the Supreme Court on Tuesday (September 22) that it would resign from Tata Sons, provided the Group obtains a “speedy resolution” and a “fair and equitable solution” in the long legal battle between the two parties. It could mark the end of the 70-year relationship between two of India’s oldest and largest business groups.

Table of Contents

Toggle

Will Cyrus Mistry’s group SP be out of Tata Sons?

Shapoorji Pallonji Mistry (SP) has offered to leave the Tata Sons after a long fight with the Tatas. The market value of the SP Group’s stake in the Tata Group’s listed entities is estimated to be approximately Rs 1.48 billion based on the market capitalization of all the Tata Group’s listed companies.

What is the Supreme Court case about?

Tata Sons filed a petition with the Supreme Court earlier this month to prevent SP group companies from raising capital against the security of their stake in Tata Sons. The Tatas argued that the Articles of Association (AoA) state that stocks cannot change hands, not even to lenders or other parties, and that the right of first refusal belongs to Tata Sons. The SP Group planned to raise funds for the Group’s real estate expansion by pledging shares in Tata Sons.

What happened on Tuesday in the Supreme Court?

The SP group told the Supreme Court that “a separation from the Tata group is necessary due to the potential impact this ongoing litigation could have on livelihoods and the economy.” The Tata Group is open to the purchase of shares in Tata Sons held by the SP Group to contribute to the latter’s fundraising efforts. The Supreme Court prevented SP Group from transferring or pledging shares of Tata Sons.

How much SP Group has in Tata Sons and what is its value?

The SP group has an 18.37% stake in Tata Sons, which is the holding company of the Tata group. While the total market capitalization of 17 listed entities in the Tata group is 12.96 lakh crore, the valuation of the SP group’s interests in the listed entities of the companies in the Tata group is approximately 1.48 rupees. lakh crore. Since Tata Sons is also the holding company of the unlisted entities of the Tata group, SP Group would also have an interest in their valuation, which will have to be prepared separately.

Who can buy Shapoorji Pallonji Group’s stake?

While SP Group said its separation from the Tata Group was necessary, the Tata Group said it was ready to buy SP Group’s stake in Tata Sons. It is known with certainty that the Tata Sons bylaws state that if a Tata Sons shareholder wants to sell their shares, they must first offer them to Tata Sons. Then, Tata Sons will decide on a fair market value and offer it to the shareholder.

Your Comprehensive Guide to the Common University Entrance Exam LLB (CUET LLB)

Delhi University to Launch One-Year Postgraduate Programme in 2026

CLAT 2025 Counselling Registration Window Closes Today

The Surge in Indian Students Studying Abroad | A Five-Year Analysis

IIM CAT Result 2024 | 14 Candidates Score Perfect 100 Percentile

AIBE 19 Exam 2024 | Complete Guide

NLSIU Bengaluru to Launch 3-Year BA (Hons) Programme in 2025 | Key Details

CUET-UG to Be Fully Online: Key Changes Announced by UGC

D.Pharma Course in India | Careers After Class 12th

The Draft UGC (Minimum Standards of Instructions in the Award of UG and PG Degrees) Regulations 2024 | A Comprehensive Overview

Essential commodities revised

On Tuesday, Rajya Sabha passed the Essentials Commodities (Amendment) Bill 2020 which aims to deregulate products such as grains, legumes, oilseeds, edible oils, onions and potatoes. The bill was presented and approved at Lok Sabha last week.

Table of Contents

Toggle- It replaces an ordinance that the government enacted on June 5, as well as two other ordinances on the agricultural sector.

- As with the other two ordinances (also passed as bills) that sparked protests from farmers in Punjab and Haryana, the provisions of this bill have also raised concerns.

What is the invoice about?

- This is a four-page bill that amends the Essential Products Act of 1955 by introducing a new subsection (1A) in section 3.

- After the amendment, the supply of certain food products, including cereals, legumes, oilseeds, edible oils, potatoes, can only be regulated in extraordinary circumstances, including an extraordinary increase in prices. , wars, famines and serious natural calamities.

- In fact, the amendment removes these elements from the scope of Article 3 (1), which empowers the central government to “control the production, supply, distribution, of goods etc.”

- Previously, these products were not mentioned in section 3 (1) and the reasons for invoking this section were not specified.

- The amendments establish that “said order of regulation of the limit of stocks does not apply to a processor or participant in the value chain of an agricultural product, if the limit of stocks of said person does not exceed the general limit of the installed processing capacity or export demand in the case of an exporter … “

How do you define a “commodity”?

- There is no specific definition of products in the Essential Products Act of 1955. Section 2 (A) states that a “product” means a product specified in the annex to the act.

- The law empowers the central government to add or remove a product from the list.

- The Center, if it is convinced that it is necessary to do so in the public interest, may mark an item as essential, in consultation with state governments.

- According to the law enforcement Ministry of Consumer Affairs, Food and Public Distribution, the program currently contains seven commodities: drugs; inorganic, organic or mixed fertilizers; food products, including edible oils; wood yarn made entirely of cotton; petroleum and petroleum products; raw jute and jute textiles; food crop seeds and fruit and vegetable seeds, livestock fodder seeds, jute seeds, cotton seeds.

- By declaring a commodity, the government can control the production, supply and distribution of that commodity and impose an inventory limit.

Under what circumstances can the government impose limits on stocks?

- Although the 1955 law did not provide a clear framework for imposing limits on stocks, the amended law establishes a trigger price.

- It says that agricultural food products can only be regulated in extraordinary circumstances such as wars, famines, extraordinary price increases and natural calamities.

- However, any action on the imposition of stock limits will be based on the trigger price.

- Therefore, in the case of horticultural products, a 100% increase in the retail price of a commodity in the preceding 12 months immediately or above the average retail price of the last five years, whichever is less two, it will be the trigger to call the stock limit.

- For nonperishable agricultural food products, the trigger price will be a 50% increase in the retail price of the product in the immediately preceding 12 months or above the average retail price of the last five years, whichever is less.

- However, exemptions from stock storage limits will be granted to processors and participants in the value chain of all agricultural products and orders related to the public distribution system.

- Price triggers will also minimize the above uncertainties associated with ordering below inventory limits. This will now be more transparent and will contribute to better governance, ” said a source from the Consumer Ministry.

“The last 10 years have been marked by periods of prolonged application of Community law. Once imposed, they were for extended periods: legumes from 2006 to 2017, rice from 2008 to 2014, edible oil seeds from 2008 to 2018. Amendments to Community law aim to remove this uncertainty by defining criteria for the process of imposing limits on stocks and processing is more transparent and accountable, ”

said the source.

Why was this need felt?

- The 1955 law was enacted at a time when the country was facing a food shortage due to persistently low levels of food grain production.

- The country relied on imports and assistance (such as the import of wheat from the United States under PL-480) to feed the population.

- To prevent the hoarding and black market marketing of food products, in 1955 the Essentials Act was passed.

- But now the situation has changed. A note prepared by the Ministry of Consumption, Food and Public Distribution shows that wheat production has increased tenfold (from less than 10 million tonnes in 1955-56 to over 100 million tonnes in 2018-19), while rice production more than quadrupled (from around 25 million tonnes to 110 million tonnes in the same period). The production of pulses has increased by a factor of 2.5, from 10 million tonnes to 25 million tonnes.

- In fact, India has now become an exporter of various agricultural products.

What will be the impact of the changes?

- The main changes are aimed at liberating agricultural markets from the constraints imposed by permits and mandi originally designed for an era of scarcity.

- The move is expected to attract private investment in the value chain of products removed from the list of essentials, such as grains, pulses, oilseeds, edible oils, onions and potatoes.

- While the purpose of the law was originally to protect the interests of consumers by controlling illegal business practices such as hoarding, it has now become a barrier to investment in the agricultural sector in general and post-industrial activities harvest in particular.

- Until now, the private sector was reluctant to invest in cold chains and storage facilities for perishable products, as most of these products fell within the scope of EU legislation and could lead to sudden stock limits. The amendment seeks to address these concerns.

Why is he opposed to it?

- It was one of three ordinances / bills that sparked protests from farmers in parts of the country.

- The opposition says the amendment will hurt farmers and consumers and only benefit storers. They say the price triggers envisioned in the bill are unrealistic, so high that they will hardly ever be invoked.

Your Comprehensive Guide to the Common University Entrance Exam LLB (CUET LLB)

Delhi University to Launch One-Year Postgraduate Programme in 2026

CLAT 2025 Counselling Registration Window Closes Today

The Surge in Indian Students Studying Abroad | A Five-Year Analysis

IIM CAT Result 2024 | 14 Candidates Score Perfect 100 Percentile

AIBE 19 Exam 2024 | Complete Guide

NLSIU Bengaluru to Launch 3-Year BA (Hons) Programme in 2025 | Key Details

CUET-UG to Be Fully Online: Key Changes Announced by UGC

D.Pharma Course in India | Careers After Class 12th

The Draft UGC (Minimum Standards of Instructions in the Award of UG and PG Degrees) Regulations 2024 | A Comprehensive Overview

ESG funds

Although they are heavily invested in global investments, ESG funds, absorbing the environment, social responsibility and corporate governance in their investment process, are also seeing a growing interest in the Indian mutual fund industry.

Table of Contents

Toggle- While there are currently three systems in the ESG space managing nearly Rs 4,500 crore (two of which were launched in the past 15 months), at least five other fund houses have lined up their new programs.

- ICICI Prudential Mutual Fund which launched its ESG fund on September 21, 2020 has already raised more than Rs 500 crore in its current NFO. We know that Kotak Mahindra AMC should be released soon with its ESG NFO fund and others to follow.

What is ESG?

- ESG investing is used as a synonym for sustainable investing or socially responsible investing. It examines three key areas: the environment, social responsibility and corporate governance.

- Therefore, when selecting a stock to invest in, the ESG fund first pre-selects companies that score high on these three parameters, then analyzes the fundamentals and financial factors in its investment decision process.

- Therefore, the programs will focus on companies that adopt environmentally friendly practices, follow ethical business practices and are respectful of employees, among others.

Why is there so much focus on ESG now?

- Fund companies say modern investors are re-evaluating traditional investment approaches and, when investing, they are looking at the impact this has on the planet as a whole.

- This paradigm shift is forcing businesses, investment firms, and asset managers to realize that investors are no longer just about returns. As a result, asset managers quickly began to integrate ESG factors into investment practices.

- Even on the performance front, fund managers argue that global non-ESG-compliant companies tend to underperform in the long run due to issues such as higher cost of capital, increased volatility due to litigation , labor strikes, accounting fraud and other aspects of governance irregularities.

What is the ESG size?

- Globally, ESG is growing year by year. There are over 3,300 ESG funds around the world and their number has tripled over the past decade. The value of global assets that apply ESG to investment decisions now stands at $ 40.5 trillion.

- In India, there are currently three systems: SBI Magnum Equity ESG (Rs 2,772 crore), Axis ESG (Rs 1,755 crore) and Quantum India ESG Equity (Rs 18 crore), following the ESG investment strategy in India.

- While the ICICI Prudential program launched its NFO last week, Kotak Mahindra AMC is expected to launch its NFO soon and more are expected to follow.

What change can this bring?

- As ESG funds gain momentum in India, fund managers say companies will be forced to follow better governance, ethical practices, respect for the environment and social responsibility.

- Overall there has been a big change on this front as there are so many pension funds, sovereign wealth funds, etc. do not invest in companies considered polluting, they do not follow social responsibility or tobacco companies, experts believe this will force companies doing business more responsibly.

- Industry insiders say that companies in the tobacco and coal sector, those that generate hazardous waste from their chemical plant and do not manage it properly, and sectors that consume a lot of water and do not follow best practices in water reuse, as well like companies that dump without treatment. Trash on the ground, water, or air will have a hard time putting funds into it.

- Industry experts say that conflicts exist at various levels and that many investors around the world seeking to create lasting wealth do not want to be associated with such conflicts.

- For example, while the global tobacco industry’s annual profits amount to $ 35 billion, it is also a cause of nearly 6 million deaths annually, and investors are increasingly sensitive to these realities.

Your Comprehensive Guide to the Common University Entrance Exam LLB (CUET LLB)

Delhi University to Launch One-Year Postgraduate Programme in 2026

CLAT 2025 Counselling Registration Window Closes Today

The Surge in Indian Students Studying Abroad | A Five-Year Analysis

IIM CAT Result 2024 | 14 Candidates Score Perfect 100 Percentile

AIBE 19 Exam 2024 | Complete Guide

NLSIU Bengaluru to Launch 3-Year BA (Hons) Programme in 2025 | Key Details

CUET-UG to Be Fully Online: Key Changes Announced by UGC

D.Pharma Course in India | Careers After Class 12th

The Draft UGC (Minimum Standards of Instructions in the Award of UG and PG Degrees) Regulations 2024 | A Comprehensive Overview

Enzyme-Linked Immunosorbent Assay – ELISA test

Table of Contents

ToggleWhat is an ELISA test ?

An enzyme-linked immunosorbent test, also called an ELISA or EIA, is a test that detects and measures antibodies in the blood. This test can be used to determine if you have antibodies related to certain infectious conditions. Antibodies are proteins that your body makes in response to harmful substances called antigens. An ELISA test may be used to diagnose:

- HIV, which causes AIDS

- Lyme disease

- pernicious anemia

- Rocky Mountain spotted fever

- Rotavirus

- squamous cell carcinoma

- syphilis

- toxoplasmosis

- varicella-zoster virus, which causes chickenpox and shingles

- Zika virus

ELISA is often used as a screening tool before ordering further testing. A doctor may suggest this test if you have signs or symptoms of the above conditions. Your doctor can also order this test if you want to exclude any of these conditions.

The ELISA test involves taking a sample of your blood. First, a health professional will clean your arm with an antiseptic. Then, a tourniquet or band will be applied around your arm to create pressure and make your veins swell with blood. Next, a needle will be placed into one of your veins to take a small blood sample. When enough blood has been drawn, the needle will be removed and a small bandage will be placed on the arm where the needle was. You will be asked to maintain pressure at the site where the needle was inserted for a few minutes to reduce blood flow. This procedure should be relatively painless, but your arm may throb a little after it’s done. The blood sample will be sent to a laboratory for analysis. In the laboratory, a technician will add the sample to a Petri dish containing the specific antigen related to the condition for which the test is being performed. If your blood contains antibodies to the antigen, the two will unite. The technician will verify this by adding an enzyme to the Petri dish and observing how your blood and antigen react. It can have the condition if the content of the plate changes color. The degree of change caused by the enzyme allows the technician to determine the presence and amount of antibodies.

There are very few risks associated with this test. These include: infection, feeling faint, bruising, bleeding more than usual.

What do the results mean?

The way test results are reported varies depending on the laboratory performing the analysis. It also depends on the condition for which the test is performed. Your doctor should discuss your results and what they mean. Sometimes a positive result means you don’t have the condition. False positives and false negatives can occur. A false positive result indicates that you have a condition that you do not actually have. A false negative result indicates that you do not have a condition when you really do. For this reason, you may be asked to repeat ELISA again in a few weeks, or your doctor may order more sensitive tests to confirm or refute the results.

Your Comprehensive Guide to the Common University Entrance Exam LLB (CUET LLB)

Delhi University to Launch One-Year Postgraduate Programme in 2026

CLAT 2025 Counselling Registration Window Closes Today

The Surge in Indian Students Studying Abroad | A Five-Year Analysis

IIM CAT Result 2024 | 14 Candidates Score Perfect 100 Percentile

AIBE 19 Exam 2024 | Complete Guide

NLSIU Bengaluru to Launch 3-Year BA (Hons) Programme in 2025 | Key Details

CUET-UG to Be Fully Online: Key Changes Announced by UGC

D.Pharma Course in India | Careers After Class 12th

The Draft UGC (Minimum Standards of Instructions in the Award of UG and PG Degrees) Regulations 2024 | A Comprehensive Overview

Recent Posts

- Your Comprehensive Guide to the Common University Entrance Exam LLB (CUET LLB)

- Delhi University to Launch One-Year Postgraduate Programme in 2026

- CLAT 2025 Counselling Registration Window Closes Today

- The Surge in Indian Students Studying Abroad | A Five-Year Analysis

- IIM CAT Result 2024 | 14 Candidates Score Perfect 100 Percentile

Categories

Recent Posts

- Your Comprehensive Guide to the Common University Entrance Exam LLB (CUET LLB) 21st December 2024

- Delhi University to Launch One-Year Postgraduate Programme in 2026 21st December 2024

- CLAT 2025 Counselling Registration Window Closes Today 20th December 2024

- The Surge in Indian Students Studying Abroad | A Five-Year Analysis 20th December 2024

- IIM CAT Result 2024 | 14 Candidates Score Perfect 100 Percentile 20th December 2024

- AIBE 19 Exam 2024 | Complete Guide 19th December 2024