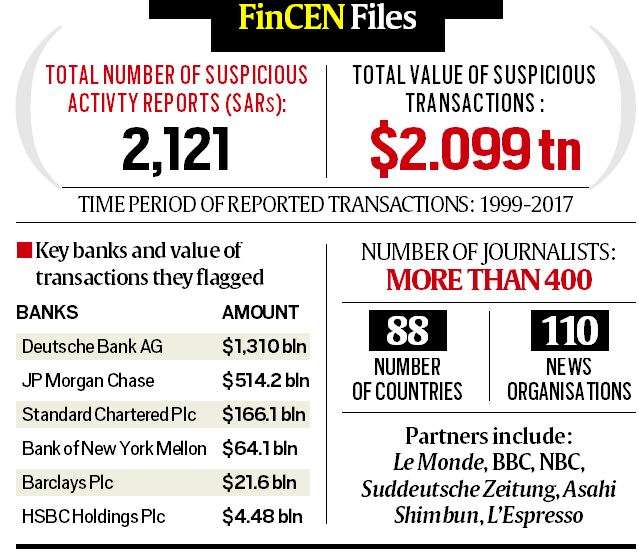

What are FinCEN files?

The FinCEN files refer to a collection of over 2,100 “suspicious activity reports” (SAR) filed by banks with the Financial Crimes Enforcement Network of the United States Department of the Treasury, the agency which acts as the main global regulator in the fight against money laundering.

- The files identify at least $ 2 trillion in transactions between 1999 and 2017, marked as possible evidence of money laundering or other criminal activity by compliance officials of banks and financial institutions.

So what is a SAR? When should they appear?

The SAR or Suspicious Activity Report is a document submitted by banks and financial institutions to report suspicious activity to US authorities, in this case FinCEN. These are confidential, so secret that the banks cannot confirm their existence. In fact, even the account holder does not know when a transaction related SAR is deposited into that account.

- SARs are filed with FinCEN in a prescribed format and are intended to be a red flag, within 30 days of the transaction; criminal funds or any form of dirty money; insider trading; potential money laundering; financing of terrorism; any transaction that raises suspicion.

- These include rounded amounts, for example $ 100,000, which are sent in multiple transactions; transfers where there is no apparent economic link between the parties (a diamond dealer paying a pizzeria for computer parts); transactions in high risk jurisdictions (offshore havens, conflict zones); transactions to / by PEPs (politically exposed persons) and, finally, unfavorable media reports on the parties.

Who can file a SAR?

- Banks, sure, but now that list has been expanded to include brokerage houses, brokers, and casinos. Failure to submit the SAR can result in heavy penalties. In recent years, Deustche Bank, HSBC and Standard Chartered Bank, among others, have received huge fines for inadequate supervision. Credit card systems are not required to submit RAS and all taxpayers must keep RAS records for five years.

But is the SAR a test of criminality, of illegality? If not, what is its importance?

- A SAR is not a charge, it is a means of alerting regulators and law enforcement to possible irregular activities and crimes. SARs are shared by FinCEN with law enforcement authorities including the FBI, Immigration, and US Customs, they are used to detect crimes, but not as direct evidence to prove legal matters. In the world of international finance, where money circulates under several levels to evade or avoid taxes, SARs are the first red flags.

Is there an equivalent of SAR in India?

- Yes. The Financial Intelligence Unit of India (FIU-IND) performs the same functions as FinCEN in the U.S. Under the Ministry of Finance, it was established in 2004 as the nodal agency responsible for suspicious financial transactions.

- The agency is authorized to obtain monthly cash transaction reports (CTR) and suspicious transaction reports (STR) and reports of cross-border wire transfers from public and private sector banks under the Prevention Act PMLA Money Laundering).

- Banks in India are required to provide a monthly CTR to FIU on all transactions over Rs 10 lakh or its equivalent in foreign currency or a series of fully connected transactions totaling more than Rs 10 lakh or its equivalent in foreign currency.

- ROS and CTR are analyzed by the FIU and suspicious or questionable transactions are shared with agencies such as the Compliance Department, the Central Bureau of Investigations and Income Tax in order to launch surveys to verify possible money laundering cases, money, tax evasion and terrorist financing.

- The CRF’s 2017-2018 annual report reveals that it received a record 14 lakh of RTS after demonetization, three times the number of RTS submitted the previous year.

How is FinCEN Files based on the Panama Papers, Paradise Papers and the Offshore Leak Series?

- Countries keep their banking transaction alerts within their borders. FinCEN files indicate that after the series of disclosures and leaks of overseas holdings in tax havens, the veil of confidentiality can be lifted even on wire and bank transfers.

- One benchmark was the publication of the Panama Papers in 2016 and, as calculated by the ICIJ last year, the total tax collected as a result of the global media investigation was $ 1.2 billion.

- In India, the figures provided by the Central Board of Direct Taxes (CBDT) do not refer to taxes collected, but to undeclared taxes collected which as of mid-2019 amounted to Rs 1,564 crore.

What clues could the FinCEN archives give researchers in India?

- The clear message for agencies in India is that their cases of financial fraud and corruption are being reported by the most powerful regulator in the world.

- This is because FinCEN files contain SARs that in many cases of Indian entities and individuals mention their financial history of alleged wrongdoing.

- There are bank transaction details that give a clear indication of round trips, money laundering, or transactions with shell-like entities. For the Indian banking sector, FinCEN’s files highlight the dangers posed by correspondent banks and raise a very relevant question: the thousands of transactions involving Indian entities and individuals reported by FinCEN have also been reported by banks to the CRF here, especially since 44 Indian banks were cited in the secret data, and if so, what was the result?

How did these files get to ICIJ?

- These documents were compiled by Congressional committees investigating Russian interference in the 2016 US presidential election. BuzzFeed News obtained these tapes and shared them with the International Consortium of Investigative Journalists. ICIJ has partnered with a team of news organizations to investigate the secret world of banking and money laundering.

- BuzzFeed News referenced these SARs in 2018 to reveal secret payments to shell companies controlled by Paul Manafort, who is currently serving a federal prison sentence at his home in a case based primarily on these transactions. Former US Treasury Department official Natalie Mayflower Sours Edwards has been charged with conspiracy to unlawfully disclose documents to Buzzfeed. Buzzfeed has not commented on its source.

More Stories

Delhi University to Launch One-Year Postgraduate Programme in 2026

CLAT 2025 Counselling Registration Window Closes Today

IIM CAT Result 2024 | 14 Candidates Score Perfect 100 Percentile