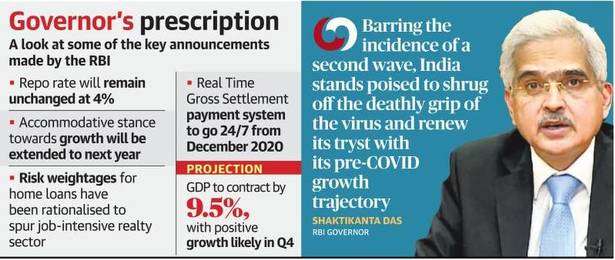

India’s central bank on Friday reiterated its determination to reactivate growth impulses in the economy and mitigate the worst effects of the COVID-19 pandemic, extending its accommodative policy for the remainder of this year and 2021-2022, even when that was the key rates unchanged in the face of high inflation.

- Reserve Bank of India Governor Shaktikanta Das said growth could “come out of contraction” for the January-March 2021 quarter, as September’s economic indicators and the COVID -19 load curve show “silver lights”. However, real GDP (gross domestic product) for the full year is expected to decline by 9.5%, “with downside risks”.

- As headline inflation has persisted above the tolerance band, Das said the central bank expects consumer prices to remain high in the September print, but gradually come down towards the 6% target in the third year. This is the first time the RBI has shared its growth and inflation projections this year.

- Calling the coming months a “decisive phase” for the Indian economy in the fight against the pandemic, the governor said; “Obviously, the deep contractions in the first quarter of 2020-2021 (when GDP contracted by 23.9%) have been left behind … With less than a second wave, India is poised to ignore the deadly claws of the virus and renew its appointment with its pre-COVID growth trajectory from confinement to reactivation “.

- Newly appointed Monetary Policy Committee members Ashima Goyal, Jayanth R. Varma and Shashanka Bhide voted unanimously in sync with the three RBI members to leave the policy buyout rate unchanged at 4% and maintain a moderate position. for “as long as it takes – at least in the current financial year and in the following year”.

- Although the RBI expects private investment and exports to be subdued in light of anemic demand conditions, Das said the agriculture sector could drive the resumption of growth through surging rural demand.

“Manufacturing companies expect a rebound in capacity utilization in the third quarter … However, if the current recovery momentum gains momentum, a faster and stronger recovery is very achievable,”

said the governor.

- Diving into the debate over the possible form of the alphabet for India’s recovery, Das delved into cricket terminology to defend his own expectation of a three-speed recovery.

- Besides agriculture, sectors such as fast-moving consumer goods, automobiles, pharmaceuticals and energy would “open their accounts” first, he said.

“The second category of sectors in the form of a strike would include sectors in which activity is gradually normalizing. The third category of sectors would include those which are confronted with “slog overs”, but can save entries. These are the sectors that are most severely affected by social distancing and require a lot of contact, ”

said Das.

- In addition to reducing a layer of bureaucracy to speed up exports, the central bank also announced a rationalization of the risk weights assigned by banks for all new mortgages sanctioned until March 31, 2022.

- This would give the government a boost. employment intensive real estate sector that has been reeling from the pandemic, the RBI said. Stock markets reacted favorably to the RBI policy statement, with BSE Sensex closing the day at 40,509 points, up 0.81%.

More Stories

AIBE 19 Result: Bar Council of India to Announce Soon – Key Details for Candidates

CUET PG 2025 Admit Card: Key Details and Important Updates

Changes in CUET Subject Combinations: Impact on Science and Commerce Students