The Reserve Bank of India has released the results of the May 2020 cycle of its Consumer Confidence Survey (CCS). In view of the Covid-19 pandemic, the investigation was conducted through telephonic interviews on May 5 and 17, 2020 in thirteen major cities, namely Ahmedabad; Bangalore Bhopal; Chennai Delhi; Guwahati Hyderabad Jaipur Kolkata Lucknow Mumbai Patna and Thiruvananthapuram.

Perceptions and expectations were obtained regarding the general economic situation, the employment scenario, the general situation of prices and the income and expenses of 5,300 households in these cities.

Highlights

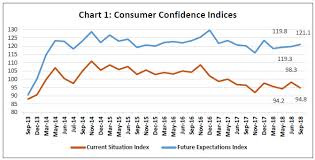

Consumer confidence collapsed in May 2020, the Current Situation Index (CSI) hit record lows and the Future Expectations Index (FEI) for next year also fell sharply, entering the area of pessimism.

The consumer’s perception of general economic conditions, the employment scenario and household income is sinking deeper into the contraction zone; while expectations regarding the general economic situation and the employment scenario for next year were also pessimistic.

General consumption spending has remained afloat, mainly due to the relative lack of elasticity of essential spending; However, consumers have reported large reductions in discretionary spending and also don’t expect a noticeable improvement in the coming year.

Other Points

- The Current Situation Index (CCI) fell into 89.4 in September from 95.7 recorded in the July round of survey, the data showed, in September 2013, it had touched 88.

- The survey also revealed that sentiment for the overall economy and employment also declined and people were less optimistic about their income over the year ahead. For instance, perception and expectation of employment have continued to decline, touching -24.5 in September from -13.1 seen in the July round of survey. However, sentiments around income have turned negative for the first time since March 2018.

- While sentiment for overall spending, primarily on essentials remains strong, sentiment for discretionary spending weakened in the September round of the survey, it said.

- India’s economy grew at its slowest pace in over six years in April-June, expanding 5%, largely because of a slowdown in consumption demand.

- RBI cut interest rates for the fifth time in a row in an attempt to give a renewed push to a slowing economy, and said it will maintain an accommodative policy stance until growth revives.

- RBI lowered its repo rate—the rate at which banks borrow from it—by 25 basis points to 5.15%. With this cut, the policy rates have come off by as much as 135 basis points so far this year to a nine-year low.

- The RBI has not yet released the Industrial Outlook Survey, which had showed “stark pessimism” among manufacturing companies, which were expecting a deterioration in sentiment across sectors for the just concluded fourth quarter of the previous fiscal year, and the current first quarter of 2020-21.

- The RBI said the current situation index (CSI) had touched a historic low and the future expectations index (FEI) for the year ahead also recorded a sharp fall, “entering the zone of pessimism”.

- Consumer spending remained intact, mostly due to relative inelasticity in essential spending. “Consumers, however, reported sharp cuts in discretionary spending and also do not expect much improvement in the coming year”.

- Households also expect a sharp rise in prices in the next three months as well as the next year to come, notwithstanding the RBI’s own expectation that inflation would taper off in the second half, which it used as a justification to cut rates on May 22.

- The Households’ Inflation Expectations Survey, conducted in 18 major cities, and based on responses from 5,761 urban households, shows that people expect a sharp rise in inflation.

- “Households’ median inflation perception and expectations increased sharply in May 2020 as compared with the March 2020 round of the survey,” the RBI said, adding three months and one year ahead median inflation expectations rose by 190 and 120 basis points, respectively, over the previous round.

- The households are now expecting increasing price pressure on food products; more households expect general prices and inflation to rise over three months as compared to previous round.

- However, the households expect prices of all product groups, especially the cost of housing, to ease over a year ahead.

- Even as the RBI did not give its own projections on inflation and growth, even as it said the economy will contract in the current fiscal year, a group of 22 professional forecasters indicated the real gross domestic product (GDP) growth rate could be a negative 1.5 per cent in 2020-21, but could rise to a positive 7.2 per cent in 2021-22.

- Real gross value added (GVA) growth could fall to a negative 1.7 per cent in 2020-21 and rise to 6.8 per cent in 2021-22.

- Real private final consumption expenditure (PFCE) is expected to decline by 0.5 per cent during 2020-21 but likely to record 6.9 per cent growth during 2021-22. Real gross fixed capital formation (GFCF) is likely to register negative growth of 6.4 per cent in 2020-21 but likely to grow by 5.6 per cent in 2021-22.

- “Forecasters have assigned the highest probability (86 per cent) to real GDP growth lying below 2.0 per cent in 2020-21,” adding, for 2021-22, highest probability (19 per cent) has been assigned to GDP growth lying between 6.0 and 6.4 per cent.

More Stories

AIBE 19 Result: Bar Council of India to Announce Soon – Key Details for Candidates

CUET PG 2025 Admit Card: Key Details and Important Updates

Changes in CUET Subject Combinations: Impact on Science and Commerce Students